what happens to the real estate market when the interest rate is higher

One of the biggest questions in real manor right now is how rise involvement rates volition impact the housing market. This used to exist a pretty easy question to answer: when interest rates go upward, it costs more to buy a habitation, and demand drops. Price appreciation slows, and homes take longer to sell. More expensive coin besides meant fewer investors holding homes so inventory would climb besides.

This year, the numbers aren't that straightforward. The market has been so hot, many worry that ascent rates will finally be the catalyst to pop the bubble. Notwithstanding, even equally rates accept begun to climb, homes are still flight off the market nearly three times faster than before the pandemic. The price of new listings continues to ascent, which is a very bullish indicator for sales prices in the coming months. Americans have been lined upwards to buy homes for so long that increased costs haven't deterred any demand… at least, not notwithstanding.

That existence said, if interest rates continue to rise, nosotros may come across some minor shifts in the market, and a brusque window of opportunity for eager buyers.

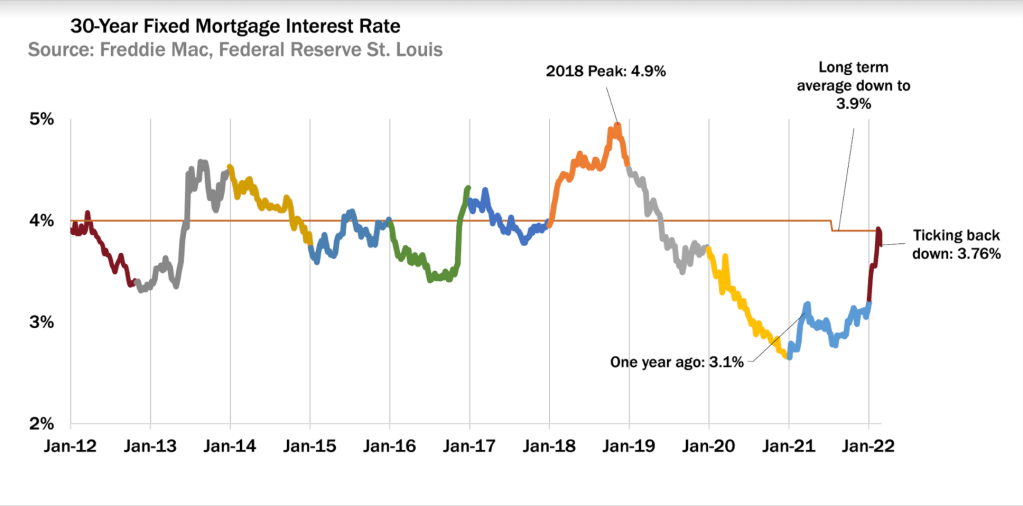

Fortunately we have 2018 every bit a guide to empathize the impact of rising involvement rates on the housing market in 2022. From September 2017 through November 2018, the 30-twelvemonth mortgage rate rose from 3.8% to 4.nine%, which was the highest point in the whole decade.

Based on the patterns from 2018, here's what to expect, and the most important signals to picket:

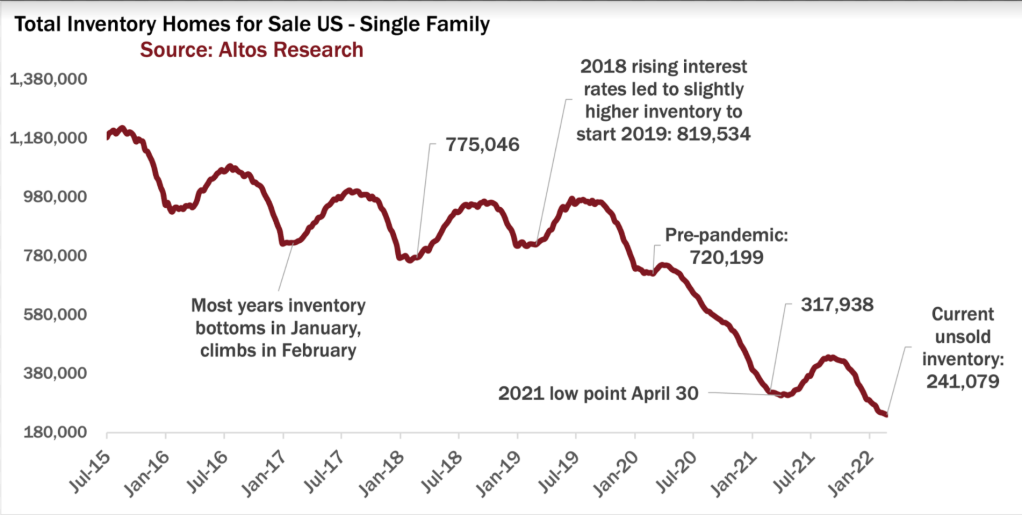

1. Inventory volition inch up… just non much.

In the 2010s, as involvement rates remained depression, more and more than Americans became real estate investors, and bachelor inventory of homes for sale dropped every twelvemonth. That trend reversed for a short time in 2018 when mortgage rates rose, and in 2019 we began the yr with 7% more inventory than in the previous year.

If interest rates climb above 4.v%, nosotros're likely to run into this pattern repeat, which would add some more listings to inventory. But considering virtually all American homeowners have a 30-year fixed mortgage below 4%, most will cull to hold onto that mortgage instead of selling.

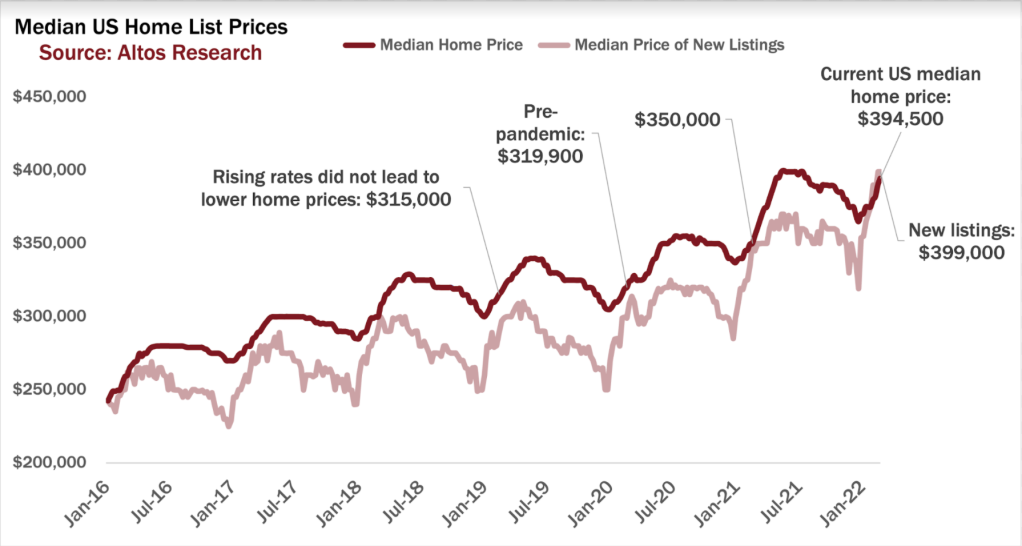

2. Abode cost growth will tiresome, simply don't expect prices to drop.

With and then much need and speedily shrinking inventory, home prices have continued to rising in Q1, even with college interest rates. The median domicile toll for single family homes this week is $394,500, which is nearly 12% college than last year at this time. Other leading indicators of home prices in the data are all bullish for futurity transaction prices.

Allow'south look at what happened in 2018: even as involvement rates rose and payments got more than expensive, this didn't result in any price driblet. In fact, the median dwelling price rose from $299,000 in early 2018 to $319,000 ane year afterward. Why? Because in real terms, those mortgage payments were yet a good deal.

Also, you can't fight demographics. In 2018, demand was accelerating as Millennials moved into prime home-ownership years. This is but as true today and volition remain truthful further into the 2020s. Equally a mortgage lender recently told me about his first-time home buyer business, "life events don't care most mortgage rates."

And let'southward not forget the issue of inflation. "Real" involvement rates are the difference betwixt inflation rates and mortgage rates, and in the inflationary economy of 2022, existent interest rates are negative. Inflation is currently running at 7% annually. If your mortgage is at 3%, four%, or even 6%(!) y'all're even so in a ameliorate fiscal position than y'all were terminal yr.

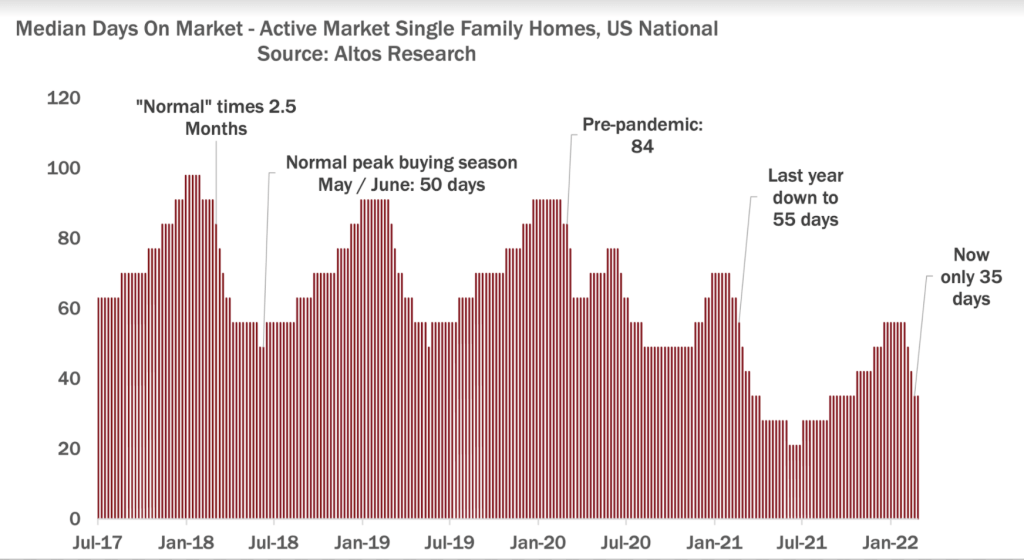

three. Homes will take a picayune longer to sell.

In a "normal" marketplace, we generally expect information technology to take an boilerplate of 80-100 days to sell a home; over the past two years, that's dropped to simply 35 days. In fact, co-ordinate to Altos Research data, one-third of homes are now sold in hours or simply a few days.

If prices and mortgage rates continue to rising, we're probable to see the breakneck pace of the market irksome downwards a footling bit. There volition be a little less contest. Buyers may be able to take their time and do full diligence on a house and not take to make an offering that afternoon. We will also probable see price reductions beginning to tick up, because more people who overprice their home won't be getting those immediate offers.

Of course, these numbers may expect different depending on the location, and investor-heavy markets such as Phoenix volition probable exist more sensitive to interest rate changes. Deals get less appealing when coin gets more expensive. Look for slightly more inventory, slightly longer market time in these markets.

So to sum information technology all up: as nosotros enter into spring, while all the leading indicators keep to bear witness robust demand, rising interest rates could take a small cooling event on the market. Buyers should motility rapidly during this window of opportunity. If history is whatever indication, it won't last for long.

Mike Simonsen is the Founder and CEO of Altos Research.

Source: https://www.housingwire.com/articles/mike-simonsen-how-rising-rates-impact-the-housing-market/

0 Response to "what happens to the real estate market when the interest rate is higher"

Post a Comment